Introducing Iterative Winter 2022 and The Problem with Stealth Mode

An introduction to the companies in Iterative Winter 2022 and why stealth mode is probably hurting you more than it's helping.

The Problem with Stealth Mode

Occasionally I run across startups in “stealth mode.” If you’re not familiar with the term, it basically means a founder is working on a startup but not telling anyone what it does. They do this because they’re worried someone will steal their idea. In reality, I suspect the real reason is the founders are afraid of failing. It’s hard to fail if no one knows what you’re doing. That’s a conversation for another day.

I generally think stealth mode significantly hurts your startup more than it helps for a few reasons.

No Feedback – The primary thing an early-stage startup needs is feedback. If you’re in stealth, you are purposefully isolating yourself from investors and founders who have relevant experience and can give you feedback on your idea.

People Can’t Help – Related to the above, if people don’t know what you’re doing, they don’t know how to help. They can’t make introductions to potential customers, partners, investors or hires.

Distrust – When you tell someone you’re in stealth mode, you’re basically telling them “I’m working on something amazing but I don’t trust you so I’m not going to tell you.” Nobody means it that way but that’s how it’ll often come off.

What about people copying your idea? It’s exceedingly rare. I can only come up with one or two cases where this has happened and probably dozens where a startup died at least in part because it was stealth.

To go even further, I think you should try as hard as possible to be the complete opposite of stealth. Talk to as many people about what you’re doing as possible. The more people you talk to, the more you get the opposite effects of the above. You get more feedback on your idea and more people can and will want to help you.

What about asking people to sign NDAs? No experienced founder or investor will sign it. Asking someone to sign an NDA is asking them to waive their rights to something before they know what it is. Frankly nobody should do that. To investors, it’s a negative signal.

Is there any scenario where it’s a good idea? Maybe one. If you’ve already launched, are growing very quickly and have no competition, it might make sense to stay stealth. That’s not even really stealth though. That’s staying very quiet about how well it’s going. The reason you’d want to do this is as follows. Imagine you found a gold mine in a public park. The last thing you want to do is start putting up signs about how there’s a gold mine. Everyone will start coming and there won’t be any gold left. Instead you want to return to the gold mine as often and as discreetly as possible and mine as much of the gold for yourself as possible. Hopefully by the time anyone else figures it out, you’ve already mined most of the gold.

That feels like a different scenario though. In almost all cases, talk to as many people about what you’re doing as possible. The fear of being copied doesn’t outweigh the benefits of talking to people.

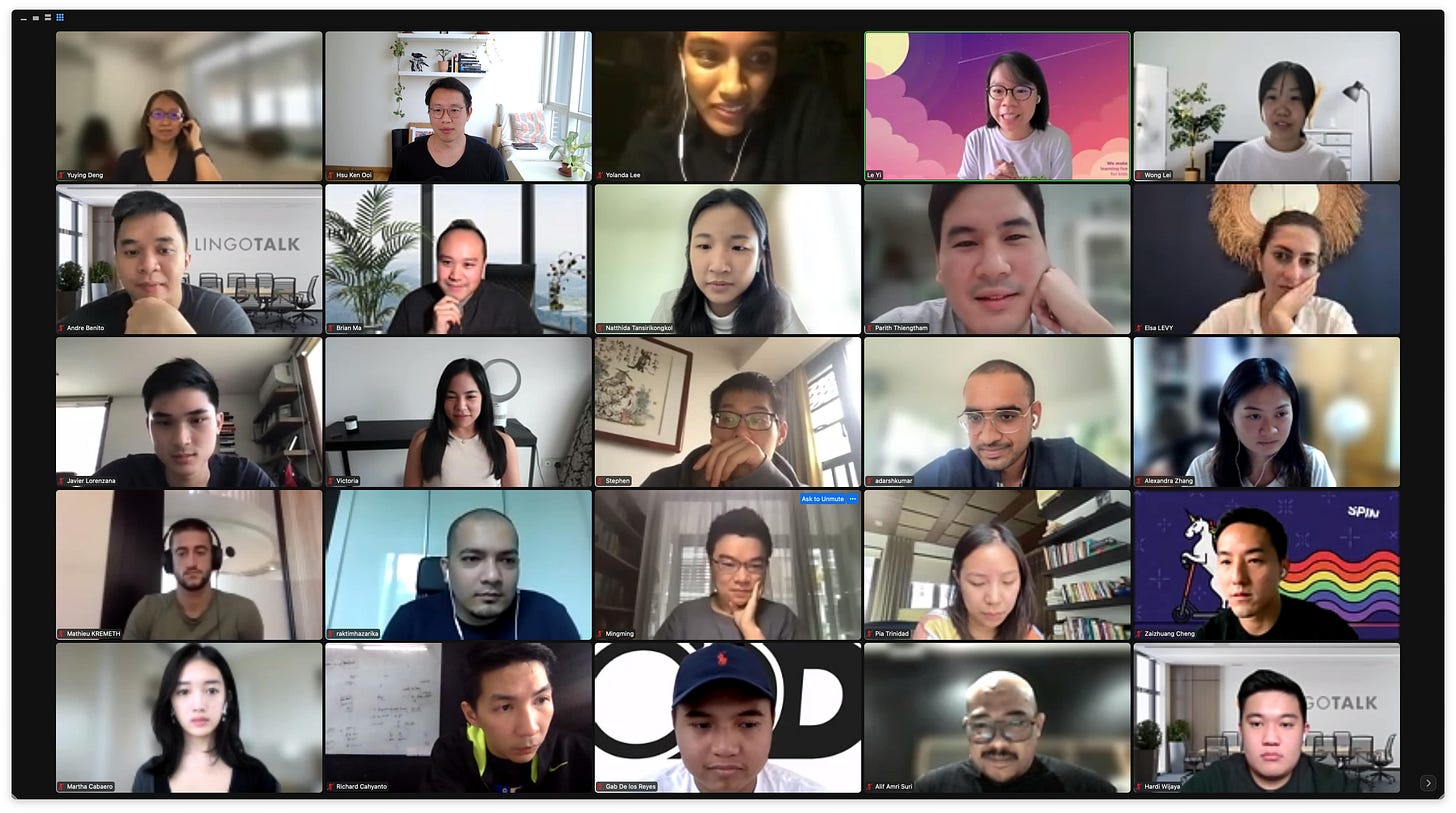

Iterative Winter 2022

Our first 3 batches have raised $130M in venture capital after our program and are now collectively worth over $720M. Our latest batch (Iterative Winter 2022) has large shoes to fill but we think this might be the strongest batch yet.

BeautyBuddy (Philippines) – Digitalizing salons

DeZy (Singapore) – Crypto-enabled high yield savings

Edsy (Thailand) – Immersive english learning

Envio (Indonesia) – B2B digital logistics platform

Esevel (Singapore) – Equip your remote team with one click

Factorem (Singapore) – Marketplace for on-demand manufacturing

LingoTalk (Indonesia) – Language learning for schools

Litto (Thailand) – Pinduoduo for Thailand

On Demand Deals (Philippines) – Quick commerce cloud convenience stores

Ottodot (Singapore)– Future schools in the metaverse

PopInventory (Singapore) – Shopify for grocery and convenience stores

Stylebase (Singapore) – StockX for second hand luxury

Uncommon (Singapore) – Private leadership network for female leaders

Up Next (Philippines) – Up-skilling digital careers through community

Although we looked at a wide range of startups, there’s clearly some clustering around education, logistics and commerce startups. For more details on each company and why we’re excited about each of them read this.

Reading

Reflecting on My Failure to Build a Billion-Dollar Company

For the type of business we were trying to build, every month of less than 20 percent growth should have been a red flag.

A cautionary tale of what happens when you raise $ from venture capitalists but don’t grow fast enough to raise the next round. Despite technically being a venture capitalist, I don’t believe that all businesses (probably most) should be venture backed. Regardless of whether someone wants to invest or not.

On the flip side, some businesses have to be venture-backed to be successful. For example, if you wanted to start a ride-hailing company in 2012 (when Grab was founded), you better have raised a lot of $ otherwise you wouldn’t have been able to compete.

If you read the whole story, you’ll find it has a happy ending. It’s different than what he expected and it took him a heck of a lot longer, but he’s happy and that counts for a lot.

Rigorous Thinking: No lazy Thinking

.. each team member should be prepared to advocate for their idea and defend it. You should be prepared to walk through the upside, downside, data points rooted in reality, and how it works given your assets and constraints.

This was written within the context of a team but it’s even more true for founders. The best founders can talk in-depth about why they’re focused on the things they’re focused on, upside, downside, supporting evidence, constraints and similarly for the things they are not doing.

As an investor, it’s generally easy to tell if the founder is a rigorous thinker (we internally use the term structured or systems thinker). Our typical line of questioning starts with why they are doing X instead of Y and drill down from there. An easy test for how strategically a founder is thinking is I ask them what their master plan (see the last few bullet points) is. Master plans typically have the form of first we’ll do X because of A constraint. Doing X will allow us to do Y. Doing Y will allow us to do Z where Z is something really impressive. If they don’t have a master plan, probably haven’t thought hard enough. If their master plan can be done in any order, the steps are disjointed and the strategy is probably not that good.

Managing People 🤯

We tend to think of trust as binary. I either trust someone, or I don't. But this isn't true. You trust different people with different things differently over time. Think of trust as something that you systemize. What kind of trust do you give a new team member? What are they expected to do in the first weeks? first month?

For many founders, being a founder is their first experience managing people (it was for me). Even if it isn’t your first experience, managing people as a founder in an early-stage startup is very different than at a larger company. In working with companies, a non-trivial percent of the time, a startup is bound by the founders ability to delegate and manage people effectively.

Although a random assortment, it’s a great list of things to remember about how to effectively manage teams. Probably something you look back on every few months to realign and assess how effective of a manager you’re being.

Jobs

Interested in working at Iterative or an Iterative company?

Iterative

DeZy (IT W22)

Crypto-enabled high yield savings.

Propseller (IT S20)

Propseller is the Modern Real Estate Agency that stands by you.

Interested but don’t see a role that fits you? Reply to this email with your Linkedin profile and what you want to do, I’ll let our startups know. There’s a lot more openings than what’s here.