Iterative – Making Your First Technical Hire, W22 Application Deadline, Referral Bounty

Making Your First Technical Hire

Q: I’m looking for a technical co-founder or hiring my first engineer. Since I’m not technical, I don’t know what qualities to look for. Any advice?

Great question and a very common among non-technical founders. There’s a big difference between a technical co-founder and first engineer but putting that aside, here’s a shortlist of things you should look for.

Generalist – An indicator of whether a startup will be successful is how quickly they can test and iterate on their ideas. Engineers who are good at many things but maybe not the best in anything, tend to be better at this. They’re also more able to adapt along with the startup. You might be building a web app now but in 3 months you’ll realize it should be an iOS and Android app.

Thoughtful – Technical decisions have significantly, long lasting impacts on your startup. Using a new experimental, esoteric framework as part of your technical stack? Not a big deal now but good luck trying to hire people who know and want to work on it later. They should be thoughtful and considerate about these kinds of trade-offs.

Communication – Related to the above. A bad engineer will make the above choice without considering anything. An okay engineer will consider it but not communicate it. A great engineer will consider it, layout the options, trade-offs, their recommendation and have a discussion about it. You might not be technical but great technical people can bring you into the discussion by explaining it in a way you’ll understand.

Business > Technology – There’s a type of engineer that’s primarily concerned with either working with the latest technologies or only on problems that are technically interesting. Stay away. A startup is a business that builds a product with technology. In that order. Depending on your industry, a lot of software development isn’t technically that interesting. Building an activity hook that triggers an email campaign isn’t technically interesting or particularly fun to build. Sure does boost retention though. Find engineers who prioritize building the business over how interesting the technology is.

Management – Optional for a first engineer but more important for technical co-founder. At some point you’ll need to hire more engineers and you’ll need someone to lead that team. If they’re good at the above, they’ll probably be good at this too. The question is whether they want to manage a team. Managing an engineering team often means they’re spending very little to no time actually coding. Not everyone wants to do that. Ask them how they feel about the prospect of that.

In addition, there’s a few common mistakes you should be aware of.

Large Company Engineers – Before I get a bunch of hate mail, this is obviously not true of every large company engineer but it’s important to be mindful of it. Engineers from larger companies, especially non-technology companies (banks, etc.), tend to be specialist. That makes sense when you’re operating at that level of scale and complexity. Furthermore, there tends to be more culture shock to how quickly and chaotic startups are. Lots of great engineers at large companies, just be mindful and don’t assume that an engineer from XYZ large company is an automatic win.

Outsourcing – Outsourcing your initial MVP can work but there’s a couple of things to consider. First, it’s likely you’ll have to throw away everything they did at some point. To agency, your product is a temporary project. Second, at some point you’re going to want to build an in-house team. Again, your ability to iterate quickly is a core competency. You don’t want to outsource core competencies. Third, it’ll likely take more work than you’re thinking. You’ll need to stay on top of them, communicate clearly and repeatedly what you want, etc.

This ended up being longer than I thought and I’m just scratching the surface. Hope it helps! If you have questions you want answered, reply to this email and I’ll help. If the topic is particularly interesting, I’ll include it in the next newsletter.

Fundraising News

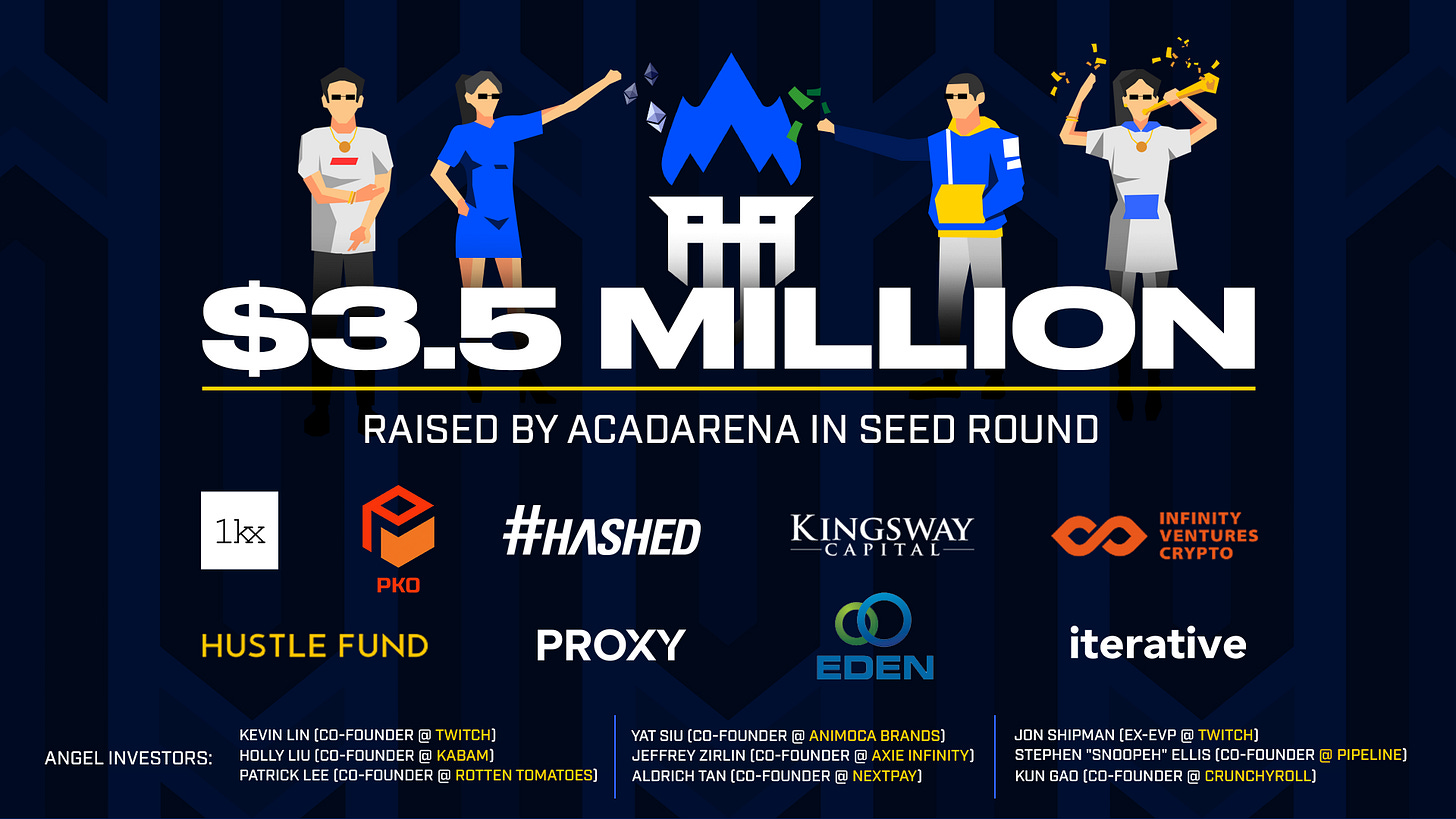

AcadArena (Iterative S21) Raises $3.5M Seed Round

While we’ve been around since 2019, now is the closest we’ve felt to our mission of building what we wish we had as students. That’s why we took the leap and sought funding to scale further and faster.

Congratulations to Ariane Lim, Justin Gorriceta-Banusing, Kevin Hoang and the rest of the Acadarena crew. Both Brian and I definitely wish you were around when we were students.

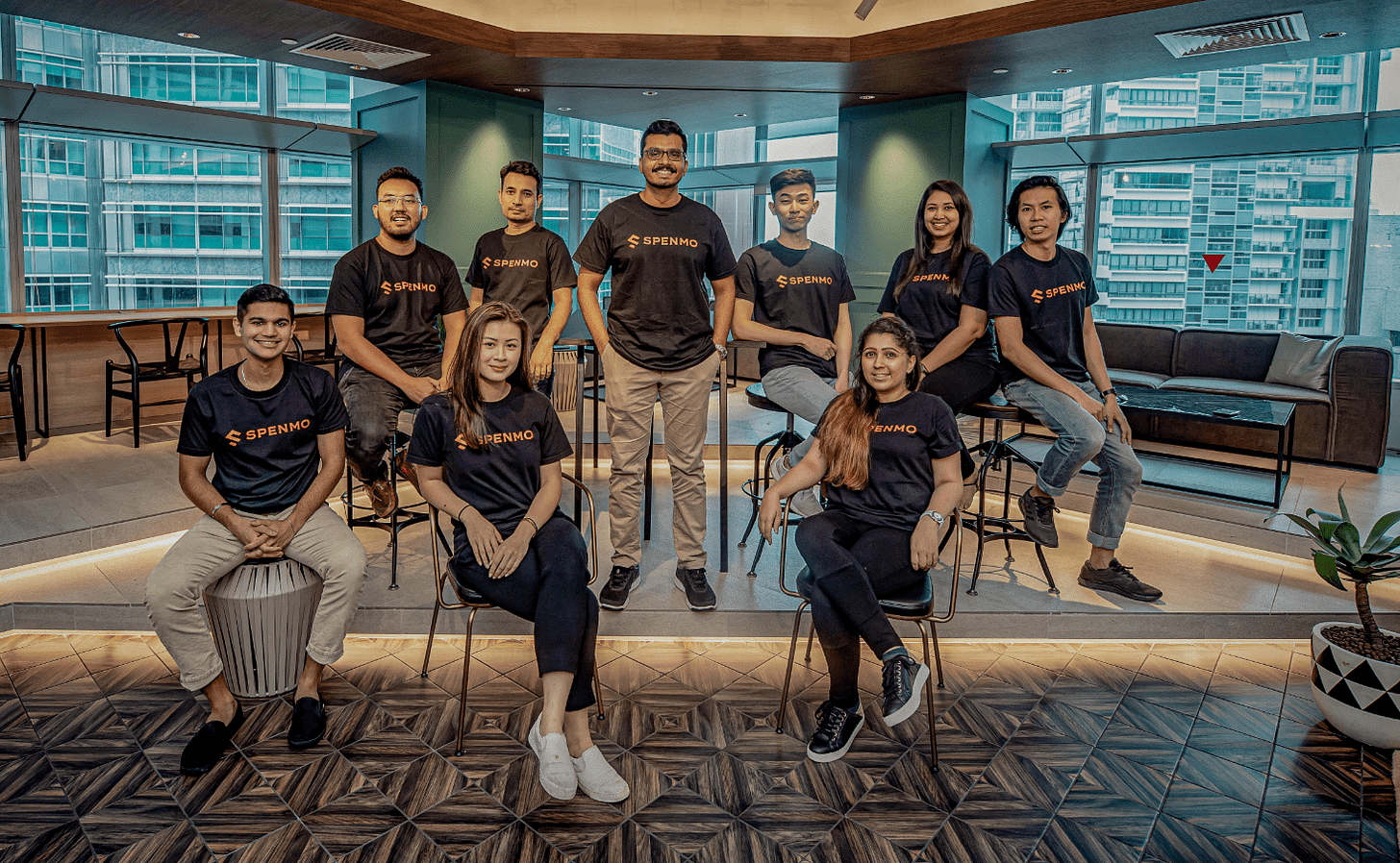

Spenmo (Iterative W21) Raises $85.4M in Series B

Congratulations to Mohandass Kalaichelvan, Isaq Ahmed and the rest of the Spenmo team on their latest round. They’re halfway to being a unicorn!

W22 Application Deadline: 17 January

The application deadline for Iterative Winter 22 is next Monday, 17 January. We’ll be accepting applications after the deadline but they will be considered late and we can’t guarantee we will get to them in time. If you’re not sure if you should apply, we strongly recommend that you do.

Orientation for Iterative Winter 22 is on Monday, 7 February.

Recommend a Startup, Make $1,000

If you recommend a startup and we end up investing in, we’ll pay you SG $1,000. I’m not kidding. Here’s how it works.

Make a Recommendation – Recommend someone through this form. I’ll reach out to them and mention that you recommended them. They need to have not previously applied to qualify.

Admissions Process – If they’re willing to be considered, they’ll go through our normal admissions process to determine if we want to make an investment.

Transfer Finder’s Fee – If we invest in a startup because you recommended them, I’ll contact you to ask for bank details so we can transfer you SG $1,000.

It seemed like a weird idea at first but it’s no different than an employee referral bonus. You should be rewarded for helping us find great startups to invest in.

What We’re Writing

Be Confident, Not Cocky by Brian Ma

A thread on how to know which one you’re coming off as and how to find the right balance.

Why Financial Projection Slides Are Mostly Useless by Brian Ma

A thread on why they’re the least useful slide in seed stage pitches and why a 3 month plan is much more useful.

Breakdown of YC’s Standard Deal by Hsu Ken Ooi

A thread on how the new deal works and whether it’s good for startups. This thread blew up (149K views in 24 hours) and there was a lively, healthy discussion in the comments.

What Founders Need to Know About VC Portfolio Constructions by Brian Ma

A thread on the inner workings of a VC portfolio and how it affects investor decision making.

What We’re Reading

2021 Letter by Dan Wang

I’m genuinely unsure of the outcome in one of the most crucial fronts of competition: whether there will be very substantial decoupling of businesses. It’s obvious that the US government and American intellectuals have succeeded in creating a climate of moral shame for doing business in China. But they have not won over the hearts and minds of the American business and financial communities. Some businesses and investors are ready to drop China, but I think they are far outnumbered by those who want to invest more. I don’t know how these forces will play out over the next decade.

The most insightful thing I’ve read on China in the last year. Most English speaking coverage feels one (sometimes more) degrees from what’s happening. Southeast Asia is, both economically and geographically, between the two countries. What happens between them will have a significant impact on us.

Tech Questions for 2022 by Benedict Evans

Sometimes the centre of gravity in tech is very clear, but as we enter 2022 there are lots of areas where trillion dollar questions are wide open. These are the questions I wonder about today, from crypto to cars to fast fashion - there are others.

These types of inflections points seem to come once every 10 years or so. I experienced the internet in the late 90s into mass adoption in the 2000s and was working on startups when the iPhone came out and mobile became the thing. For the subsequent years after both, almost everyone’s energy poured into those. That’s all people talked about and worked on.

We’re coming up on the next cycle.

Web3/Crypto: Why Bother? by Albert Wenger at USV

Today, however, I want to attempt to provide a cogent explanation for why bothering about web3 makes sense. This requires telling a bit of a story and also understanding the nature of disruptive innovation. The late Clayton Christensen characterized this type of innovation as being worse at everything except for one dimension, but where that dimension really winds up mattering a lot (and then over time everything else gets better also as the innovation is widely adopted).

Most people (right now it feels like everyone) think Web3 is the next big thing. It’s a fascinating conversation but filled with hype. Albert makes a good case without the hype.

Little known fact. In Tim Berners-Lee original specification for most of what we know as the internet, included an error code for payments that was “reserved for future use”.

Events

If you’re starting a startup or thinking about starting one, this is for you. Iterative's Southeast Asia Tour is starting again this Friday, 14 January until 11 February. Every Friday, I'll be moderating a conversation with founders from a specific country on..

Demystifying what being a founder is like

Challenges related to being a founder in their country

Answer questions from future founders (you!)

The events will be held on Zoom. To register, find your country and follow the link.

14 January: 🇧🇩 Bangladesh

Kishwar Hashemee and Ridwan Hafiz (Go Zayaan)

21 January: 🇵🇭 Philippines

Josh Supan (Shipmates) and Ariane Lim (AcadArena)

28 January: 🇹🇭 Thailand

Pearadet Mukyangkoon (Cariber) and Nithi (Mek) Satchatippavarn (MyCloudFulfillment)

4 February: 🇮🇩 Indonesia

Jessy Abdurrahman (Zi.Care) and Serano Tannason Ng

11 February: 🇻🇳 Vietnam

Charles Lee (CoderSchool (IT W21)) and Hạ (Ella) Trịnh (Vulcan Augmetics)

See you there!