Why Founders in SEA Have To Be More Effective Managers

+ Why You Can't Seem to Fundraise, A New Way to Think About Growth (from Guest Writer Daniel Shi!)

Column: Why Founders in Southeast Asia Have To Be More Effective Managers

Hsu Ken: To be successful, founders in Southeast Asia have to be more effective managers than their counterparts in San Francisco at a similar stage.

Let's do some rough calculations. The average software engineer salary in Singapore is SGD $58,279 and in San Francisco it's SGD $233,331. That's insane! And that's Singapore. You can do the math for other Southeast Asian cities.

What does that mean for founders? It means if you raise USD $5M in San Francisco, you can hire 15 engineers for 2 years. If you raise the same USD $5M in Singapore, you can hire 60 engineers for 2 years. There's a huge difference between managing a 15 person team and a 60 person team. The former you can do with minimal structure but the latter requires a thoughtful management structure to run efficiently. Add to that the complication of often having offices in multiple countries and not everyone speaking the same language, it's a serious challenge for founders.

Here are a few things to think about.

Scalable Decision Making – Not only will you be unable to keep up with the volume of decisions that need to be made by your company, you won't have the right level of knowledge to make most of those decisions. Every market is different and often there's local context that's important to know. The scalable solution is to create structures so other people can make decisions like you would (if you had the time and appropriate context).

Systems of Accountability – Similar to the above, you won't be able to keep everyone accountable so you need a system that does it automatically. At Iterative, we use OKRs, but there are lots of different ways to do this. The important thing is to set targets and have a regular cadence for people to report on how they are tracking towards their targets. For the most part, if people are hitting their targets, we don't worry too much. If they are not hitting their targets, then we take that as a sign to dig in with them and find out what we can do to change our trajectory.

Strong Local Leaders – Given the above and you can't be in each country as much as is needed, you need strong local leaders. At least one in every office and spend a significant amount of time with them. Often they are the ones that make sure the above is working for that team, reinforce the culture values and keeping a pulse of what's happening.

There's a lot of great resources on how to run companies well but it's rarely focused on Southeast Asia - and written for early stage founders so I wanted to see if I could help.

The general idea is to focus on designing the product (your company) that makes your product (your actual product). In fact, as someone who spent most of their time in product, I'd argue you need to be even more thoughtful about designing your company than your product.

If you design your company well, the product (and everything else) will design itself.

Ideas from Iterative

Why You Can't Seem to Fundraise

"I can't fundraise, what's wrong?" is a common question we often receive - and one with an answer. Here's a snippet of what Brian thinks:

“The most common reason this happens is because (1) you’re confusing investors about what you actually do (2) you get across what you do, but aren’t getting across why it’s differentiated (3) investors don’t believe your TAM (Total Addressable Market).

Quick advice on how to address each one of these:How to Not Confuse Investors — Test your pitch on your friends and see if they can summarise your company in six words or less. If they can’t, you’ve failed.

How to Differentiate – Same thing as above. Test it with your friends or other founders to see if they can name your top two competitors and why you’re better than them. What do you know that they don’t? See if they believe you.

TAM - This one is the hardest to get right because you probably don’t really know, are making up a big number, and investors probably won’t believe you anyway.

The best way to address this is to break it down into stages.

What does it look like when you tap out of market 1 (maybe a geography or product)?

Where is the adjacent market and how big is that?

What will you do after that?”

In the article, they answer more fundraising questions, like…

When and how much to raise money for my startup?

What are common mistakes in fundraising?

What is something I shouldn't say or do in a meeting with investors?

Story vs Traction

A few months back, Hsu Ken wrote this LinkedIn thread on Story vs Traction — how “it's surprisingly more advantageous (especially early on) to have a strong story, and it's easier to turn a weak story into a strong story than it is turn weak traction into strong traction." The thread got popular in the community, so he followed up with an expanded version in a blog post.

The name of the game is to have both strong traction and a strong story. But what happens when you have:

Strong traction, but a weak story?

A strong story, but weak traction?

In this post, Hsu Ken takes you through the different scenarios across the two dimensions (story/traction), what investors would typically take note of, and what you can do about it.

Ideas from Others

Daniel Shi on How To Think About Growth

We're excited to feature Daniel Shi as a guest writer in today's newsletter - Daniel Shi is an angel investor. Previously, he spent six years as an operator at Remitly, an international payments company, from early stage until IPO. He's also worked at Tencent and Amex Ventures, investing in gaming, e-commerce, and Fintech.

Recently, he wrote an article on Growth Frameworks, and we think this could benefit more founders.

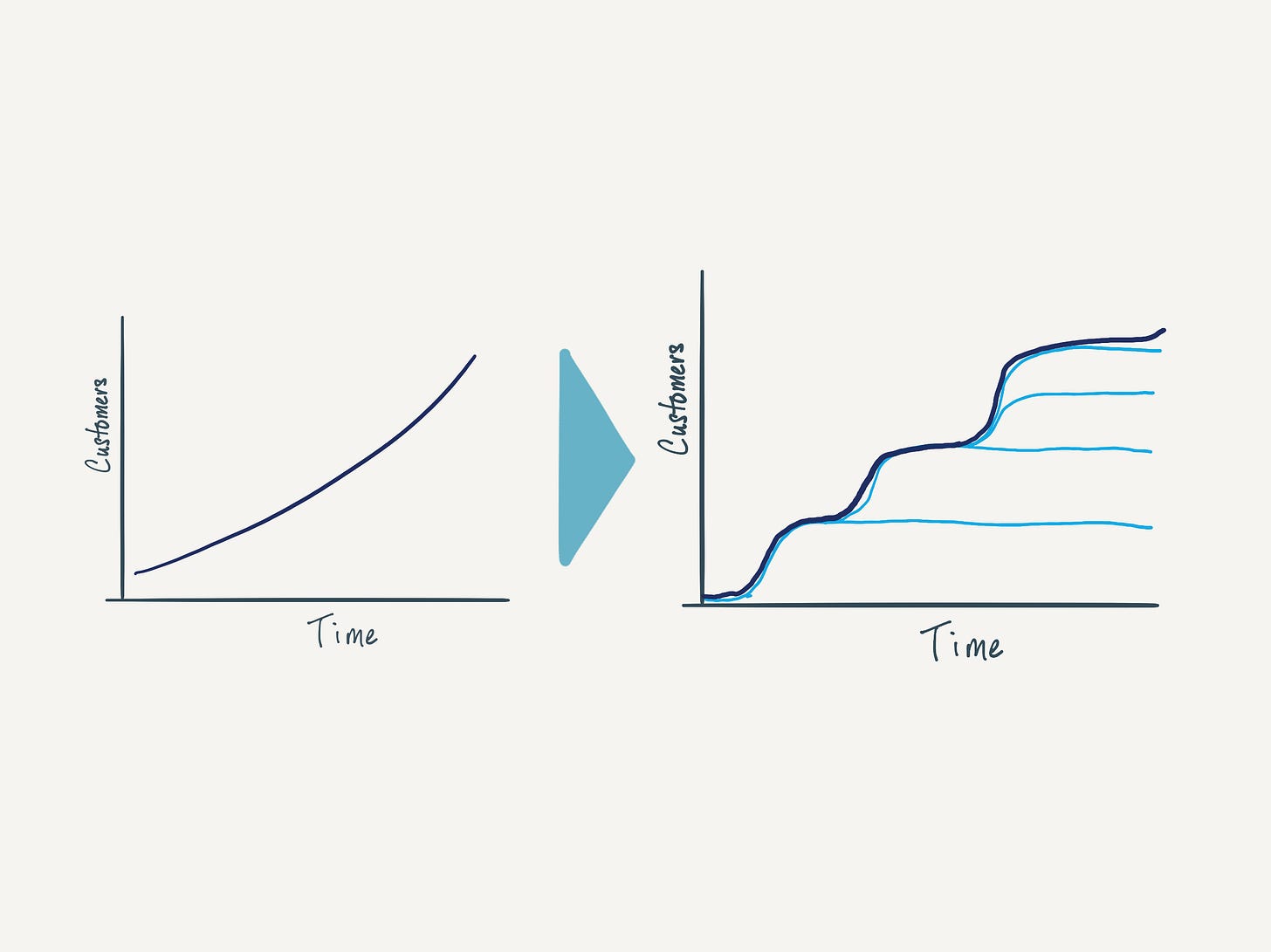

Daniel Shi: Startups need to reframe their growth framework beyond a simple “up and to the right” line. It’s wonderful to look at, but hides a sad reality: growth eventually slows. This failure of imagination is very evident right now, as we see headline after headline of once high-flying tech companies slowing down, pivoting towards profitability, and are facing layoffs.

There’s a better way to think about growth. The most enduring companies are ones that continuously stack S-curves on top of each other. This was something we did strategically at Remitly, but how should you think about S-curves and how they fall into where your company is at now?

In my article, I’m proposing a framework that could work for you, from channel to product expansion.

Spotlight on Founders

Congratulations Team Propseller on the US$12M Raise!

Congratulations Adrien Jorge and team Propseller on their US$12M raise! 🔥

Propseller was Iterative's first investment (ever!) - and we're so stoked to have been at the start of their journey towards building the largest transactional real estate brand.

They're on a mission, and they're looking for 200 people to join them. If you're interested, check out the roles here: propseller.com/careers

In the Loop

Interested to Join Iterative?

We're hiring! We're on the lookout to fill up these roles:

Talent Partner: Someone who knows what it takes to run efficient sourcing and vetting processes to help us grow in headcount this year.

Investor Relations Manager: This role will shepherd potential LPs through our fundraise process, communicate with them on our vision, strategy, and results, and secure capital for our next few funds.

Head of People: We need a scrappy, organised, and ambitious HR generalist who can also put in practice our initial recruiting processes and needs.

Content Associate: This role will help the Content Lead to produce a library of content and tools for current and future Iterative founders.

If you're interested, or know someone who's a great fit, learn more about the roles here.

Applications Are Open

Two quick updates:

We're already past the mid-checkpoint for our current batch of S22 (to the founders, thank you for working tirelessly with us!)

We're also already on the lookout for the next batch of founders! It tentatively starts early next year.

While it feels like there's a long way to go, early applications have a much higher investment rate. (We're already seeing an uptick in applications. Thank you, founders!)

Iterative invests up to $500K, and upon admission, we invest the full amount upfront and work with the founders closely for three months - apply to Iterative's W23 batch and be one of the early founders we speak to.

Thanks for sharing! You guys struck me @ “If you design your company well, the product (and everything else) will design itself.”

How it reminded me of a very important lesson from Steve Jobs — prioritising design over chance! 🤝